property tax on leased car connecticut

To learn more see a full list of taxable and tax-exempt items in Connecticut. Sales Tax Rate Over 50000.

Who Pays Personal Property Taxes On Leased Vehicles In Missouri Slfp

You can find these fees further down on the page.

. Local motor vehicle taxes and fees generally pay them unless the lease agreement requires otherwise. If you do pay the personal property tax you can deduct it. The states average effective property tax rate is 214 which is double the 107 national average.

Excise taxes in Maine Massachusetts and Rhode Island. Sales Tax Rate Under 50000. No tiene Productos en su Cesta de la Compra.

When you lease a vehicle the car dealer maintains ownership. While Connecticuts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. This page describes the taxability of leases and rentals in Connecticut including motor vehicles and tangible media property.

For vehicles that are being rented or leased see see taxation of leases and rentals. The same charge or fee can sometimes have different names depending on car company. Do you have to pay property tax on a leased car.

Connecticut collects a 6 state sales tax rate on the purchase of all vehicles. It is an annual assessment on personal property by the state and since BMWFS would own the car they would get the bill. Ct property tax on cars that are leased.

Check with your states tax or revenue department. However the state has an effective vehicle tax rate of 26 according to a property tax report published earlier this year by WalletHub which calculated taxes on a. Tax assessors bill the car dealer for vehicle taxes but whether or not they pass that on to you will be delineated in your lease contract.

For most connecticut municipalities the tax due date for the october 1st grand list bill is july 1st. Calculate Car Sales Tax in Connecticut Example. Property taxes on the vehicle are not applicable for the lessee.

Initial Car Price 2. Connecticut is unusual in that counties are not responsible for administering property taxes. Fees can differ by dealer leasing company and by the statecountycity in which you live.

Virginia has the highest vehicle taxes the report found. Instead cities and towns set rates and collect the taxes. You are a Connecticut resident AND Paid qualifying property tax on your PRIMARY RESIDENCE ANDOR MOTOR VEHICLE during 2021 AND One or both of the following statements apply.

Does Connecticut allow to write off personal property car tax for 2017. Quick question to any CT Lease holders or dealers. In most cases the agreement made between the dealer or leasing agency and the person leasing the vehicle will pass the cost of property taxes on to the lessee most.

There residents pay an effective rate of 405 meaning an annual bill of 1011. Do you pay property tax on a leased vehicle in Connecticut. To qualify for the property tax credit you or your spouse if married filing jointly must be 65 years of age or older by the end of the taxable year OR you must have claimed at least one dependent on your federal income tax return.

Motor Vehicles are subject to a local property tax. In car leasing as in buying there can be charges fees costs and taxes that often surprise newcomers. Knowing Connecticuts sales tax on cars is useful for when youre buying a vehicle in the state.

You or your spouse are 65 years of age or older by the end of the taxable year. 170 rows Town Property Tax Information. Leased and privately owned cars are subject to property taxes in connecticut.

They are not subject to local taxes. To be clear this is different than the sales tax on the sale of the car. Alaska juneau only arkansas connecticut kentucky That means you owe taxes on only 10000 instead of 30000.

Later than the thirty-first day of December next following the date the property tax is due. Full trade-in credit is allowed when computing the Connecticut Sales and Use tax if the vehicle was purchased from a licensed dealer. Connecticut car owners including leasing companies are liable for local property taxes.

Most leasing companies though pass on the taxes to lessees. Sales Tax for Car 1 30000 - 5000 0635 Sales Tax for Car 1 158750. Yes you may if you qualify.

You can find these fees further down on the page. Understand How Car Leasing Fees Charges and Taxes Work. According to Connecticuts Department of Motor Vehicles DMV you must pay a 635 percent sales tax or 775 percent sales tax on vehicles over 50000 upon the purchase of your vehicle from a.

And motor vehicle registration fees in New Hampshire. You may use this calculator to compute your Property Tax Credit if. Sales From Licensed Dealers - If the vehicle was purchased from a licensed dealer the 635 or 775 for vehicles over 50000 sales and use tax is based on the purchase price.

Failure to file by the deadline constitutes waiver of the right to claim the property tax exemption or refund for which CGS 12-8153 provides. The property tax liability for a motor vehicle that is leased rather than sold outright to someone remains with the business that holds title to the vehicle ie the leasing agency or dealer. Does BMWFS bill back the cost of the annual personal property tax in Connecticut to the lease holder.

If you didnt already know the following states apply a Personal Property Tax on all leased vehicles. Leased and privately owned cars are subject to property taxes in Connecticut. The Assessor may require you to submit motor vehicle lease verification.

In addition to taxes car purchases in Connecticut may be subject to other fees like registration title and plate fees. Tax assessors bill the car dealer for vehicle taxes but whether or not they pass that on to you will be delineated in your lease contract. Initial Car Price 1.

To calculate the property tax multiply the assessment of the property by the mill rate and divide by 1000.

Signature Auto Leasing Deals And Drive Car Lease Specials

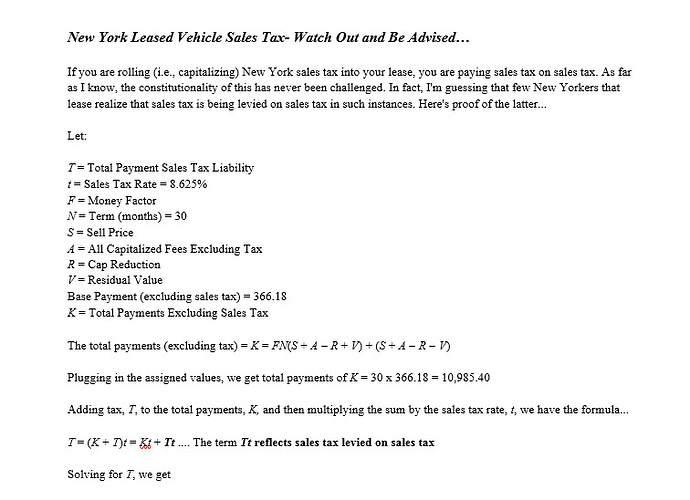

Sales Tax In Ny Off Ramp Forum Leasehackr

Connecticut S Sales Tax On Cars

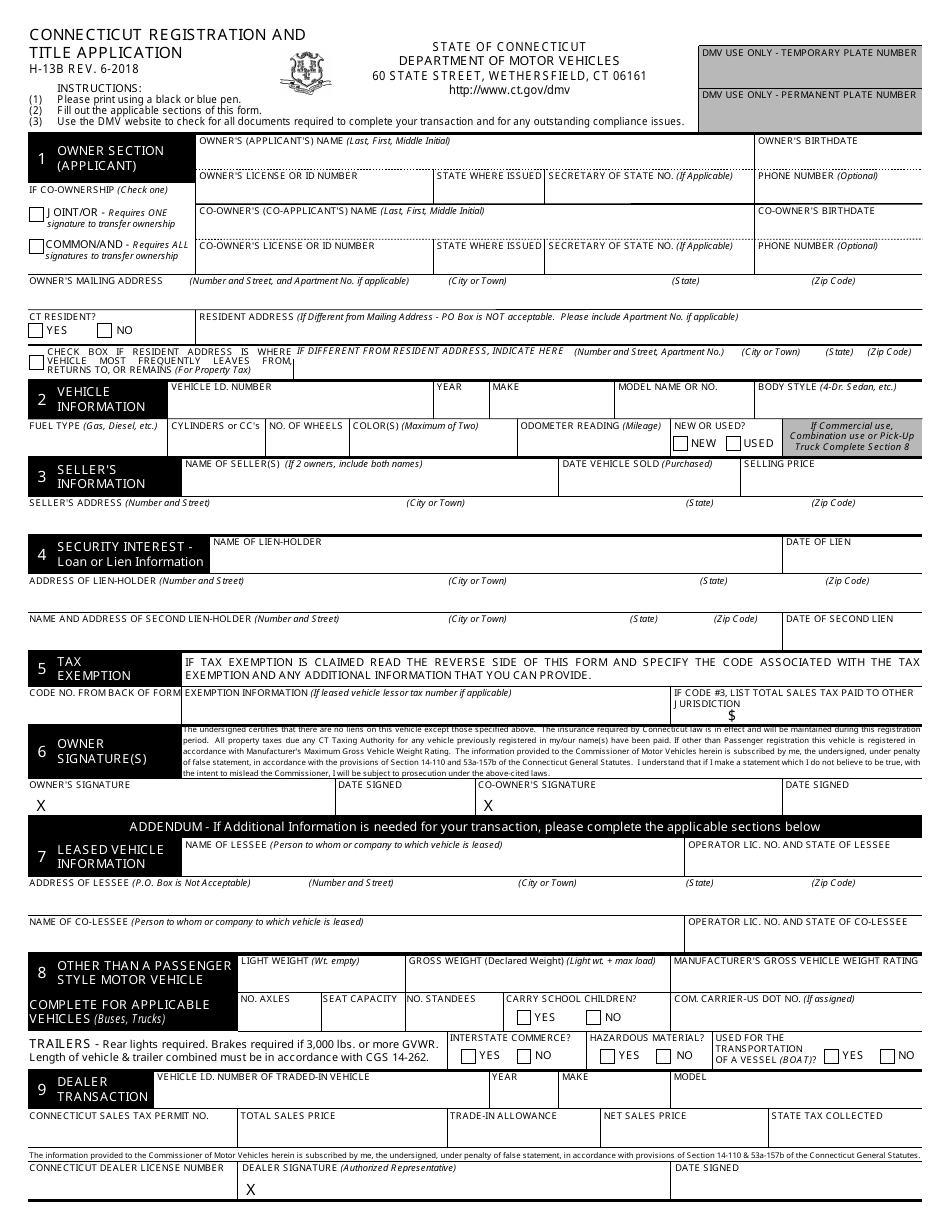

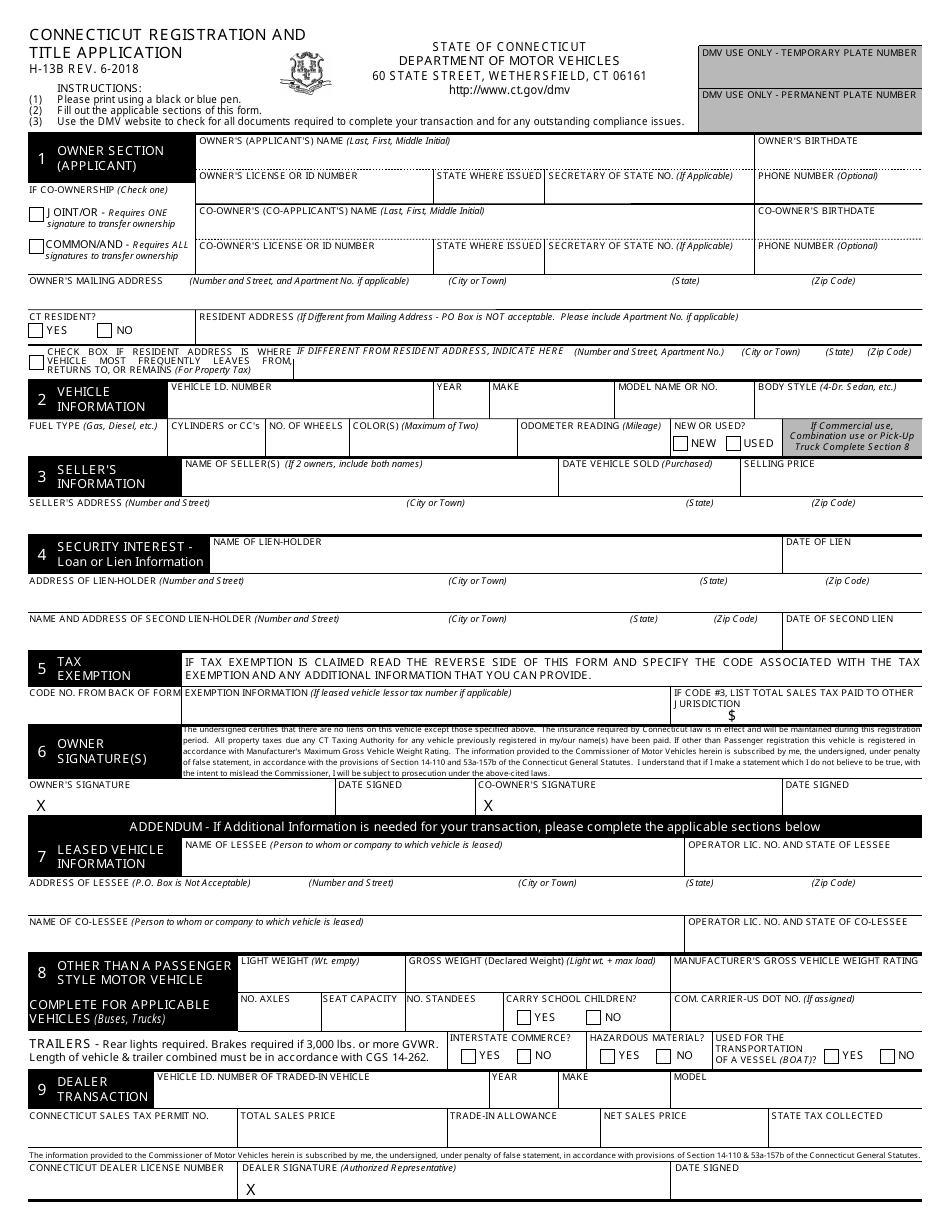

Form H 13b Download Fillable Pdf Or Fill Online Connecticut Registration And Title Application Connecticut Templateroller

General Information Assessment And Collection

Who Pays The Personal Property Tax On A Leased Car

Which U S States Charge Property Taxes For Cars Mansion Global

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars

Office Of The Tax Collector City Of Hartford

Ford Edge Lease Deals Offers Cheshire Ct

Form H 13b Download Fillable Pdf Or Fill Online Connecticut Registration And Title Application Connecticut Templateroller